Running a small business isn’t for the faint of heart, especially when it comes to managing finances. For many entrepreneurs, keeping the books balanced and the cash flowing can be a constant challenge.

Yet, some small business owners seem to have cracked the code to financial success. What’s their secret?

While there’s no one-size-fits-all answer, financially successful business owners often follow certain habits and strategies that set them apart. Curious to know what they are?

Let’s dive into the secrets that help these business owners not only survive but thrive financially. Who knows, adopting a few of these could make a big difference in your own business!

Small Business Sets Clear Financial Goals

One of the first steps toward financial success is setting clear financial goals.

Think of it like setting a destination on a map, if you don’t know where you’re going, it’s hard to know if you’re on the right path.

Financially successful business owners understand this, so they set specific goals that guide their decisions.

And these aren’t just vague goals like “make more money”; they’re detailed, actionable, and measurable.

What kind of goals are we talking about? It could be anything from reaching a certain monthly revenue to achieving a particular profit margin by the end of the year.

Some even set “stretch goals” to push their business further. The key is to keep these goals realistic yet challenging. Having a roadmap helps successful business owners focus on growth, make smarter financial decisions, and stay motivated.

Want to know a little trick? Regularly review your goals. Goals shouldn’t be set in stone; they should evolve as your business grows. Checking in on them helps you stay on track and make adjustments as needed.

They Monitor Cash Flow Closely

You’ve probably heard the saying “cash flow is king,” and it’s true! Cash flow is the lifeblood of any small business, and financially successful owners make it a priority to monitor it closely.

Imagine trying to run your business blindfolded, that’s what it’s like if you’re not keeping an eye on cash flow. Successful owners know exactly where their money is coming from and where it’s going, which helps them stay proactive instead of reactive.

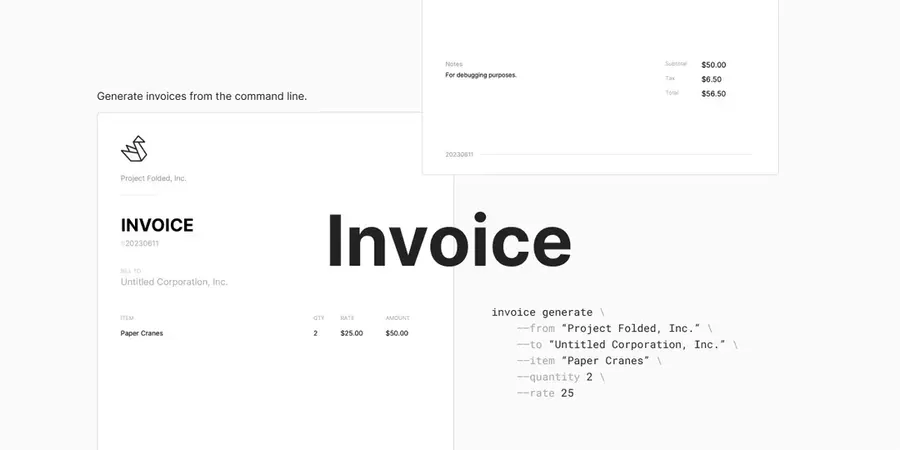

A lot of them use modern tools to keep track, like accounting software that shows cash flow in real-time and allows them to generate invoices efficiently.

They also set up regular check-ins, maybe weekly or monthly, to review income and expenses. This habit helps them spot any potential cash flow issues early, so they can avoid running into financial trouble.

Building a buffer for slow periods is another trick they use. By setting aside a portion of their revenue, they’re prepared for times when cash flow might dip. It’s all about being prepared and staying one step ahead.

They Control Costs and Minimize Debt

Here’s a secret: financially successful business owners don’t spend frivolously. They know the value of every dollar and make sure they’re investing it wisely.

Whether it’s office supplies or marketing campaigns, they look for ways to control costs and keep expenses as low as possible without sacrificing quality.

One strategy they use is negotiating with vendors to get the best prices, whether it’s for raw materials, services, or equipment. Many also leverage technology to save on things like marketing and administrative costs, opting for budget-friendly tools that get the job done without breaking the bank. Some also use business credit cards for employees to further streamline expense management, allowing for controlled spending and easy tracking of purchases to optimize budgets.

And when it comes to debt, they’re cautious. Debt isn’t always bad, especially if it’s used to invest in growth, but successful business owners are careful not to overextend.

They take on debt only when it makes sense financially and have a plan to pay it off. Excessive debt can drain cash flow and add stress, so they keep it in check.

They Diversify Revenue Streams

Relying on just one source of income can be risky for a small business.

What if that revenue stream dries up? That’s why financially successful small business owners diversify their revenue streams, creating multiple ways to earn money and increase financial resilience.

Let’s say you own a coffee shop. In addition to selling coffee, you might start offering merchandise, hosting events, or even adding a subscription service for customers to receive coffee beans at home.

The more ways you can bring in revenue, the better equipped your business will be to handle changes in the market or shifts in customer demand.

Diversification doesn’t have to be complicated. It’s about looking for opportunities that align with what your business already does well and then expanding from there.

Not only does this provide a buffer if one income stream slows down, but it can also open doors to new customers and growth.

They Invest in Financial Education and Advice

In order to make well-informed judgments, many of them invest the time to learn about taxes, cash flow management, and budgeting.

Where do they find this information? Others read books on small business finance, go to workshops, or enroll in online courses. They also don’t hesitate to contact professionals when they require more specialized guidance.

Consulting with an accountant or financial counselor can yield information and direction that may not be immediately apparent to the untrained eye.

The goal of investing in financial education is to provide a Small Business with the knowledge necessary to make better informed and self-assured decisions, not to become an accountant.

And it can be crucial to the long-term success of your company.

You don’t have to be a finance expert to run a successful business, but financially savvy owners make it a point to understand the basics.

They know that a solid grasp of financial principles can make a huge difference in how they manage their business.This habit helps them spot potential cash flow issues early, avoiding financial trouble.

Building a buffer for slow periods is another trick they use. Setting aside a portion of their revenue prepares them for times when cash flow might dip. It’s all about being prepared and staying one step ahead.

They Build Strong Client Relationships

Ever notice how some businesses seem to have loyal customers who keep coming back? That’s no accident.

Successful small business owners understand the value of strong client relationships. When clients are happy, they’re more likely to return, refer new business, and even pay on time. It’s a win-win for everyone.

Building these relationships isn’t complicated. It’s about demonstrating your worth to your clients.

Simple actions like frequent check-ins, individualized communications, and first-rate customer service have a big impact. To encourage recurring business, some owners even provide loyalty programs or other benefits to loyal customers.

Relationships with clients are also advantageous financially.

You can depend on consistent revenue without continuously seeking for new business when you have a strong foundation of devoted customers. Plus, referrals from happy clients are often more effective (and cheaper) than any marketing campaign.

They Stay Flexible and Adapt to Change

If there’s one constant in Small Business, it’s change. Financially successful Small Business owners embrace this by staying flexible and adapting when needed.

They don’t cling to a single strategy or approach—instead, they’re always evaluating what’s working and what isn’t. This adaptability allows them to pivot quickly if market trends shift or new opportunities arise.

Take the recent trend of businesses moving online. Owners who were willing to adapt found ways to reach customers digitally, whether through online stores, social media, or virtual services. This flexibility isn’t just about survival; it’s about growth.

By staying open to change and willing to try new things, financially successful owners can capitalize on trends rather than get left behind.

In actuality, this entails routinely assessing company performance and implementing data-driven improvements.

The capacity to adapt maintains a firm that is robust and prepared for whatever happens next, whether that means changing prices, developing marketing strategies, or even venturing into new markets.

Read More: Stop Overpaying for Translation: Free AI Tools Are Redefining the Future of the Industry

Contact US | ThimPress:

Website: https://thimpress.com/

Fanpage: https://www.facebook.com/ThimPress

YouTube: https://www.youtube.com/c/ThimPressDesign

Twitter (X): https://x.com/thimpress_com