In today’s fast-paced digital landscape, innovation is the key to staying ahead.

Among the myriad technological advancements, blockchain stands out as a transformative force, revolutionizing industries from finance to healthcare.

However, its true potential emerges when paired with other digital innovations.

One such symbiotic relationship exists between blockchain and Digital Innovation, creating a synergy that amplifies their impact.

In this article, we explore the fusion of digital innovation and blockchain, focusing on the remarkable synergy they create, with a particular emphasis on USDT Wallet.

The Evolution of Digital Innovation

Digital innovation has continually reshaped how we interact, transact, and conduct business.

From the advent of the internet to the rise of mobile applications, each wave of innovation has brought unprecedented convenience and efficiency.

Today, emerging technologies like artificial intelligence (AI), the Internet of Things (IoT), and blockchain are driving the next phase of digital transformation.

The Rise of Blockchain Technology

Blockchain, originally conceived as the underlying technology behind Bitcoin, has evolved far beyond its cryptocurrency roots.

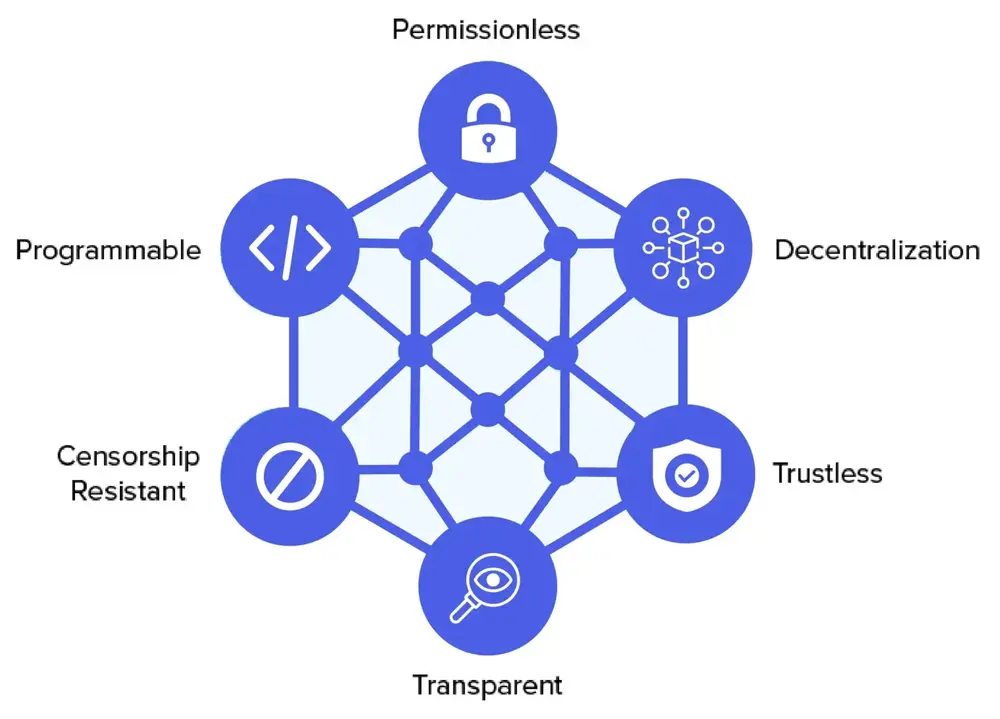

At its core, blockchain is a decentralized and immutable ledger that records transactions across a network of computers.

This technology ensures transparency, security, and trust in data exchange, making it ideal for various applications beyond finance.

Synergy Unleashed: Digital Innovation Meets Blockchain

When digital innovation intersects with blockchain technology, the synergy is undeniable.

Together, they enhance each other’s capabilities, opening doors to new possibilities and efficiencies. Here’s how this synergy unfolds:

- Enhanced Security: Blockchain’s immutable nature ensures data integrity and security, mitigating the risks associated with digital transactions.

- Streamlined Processes: Integration with digital innovations like AI and IoT enables automation and streamlining of complex processes, reducing manual intervention and errors.

- Improved Transparency: Transparency is a hallmark of blockchain technology, providing stakeholders with real-time visibility into transactions and processes.

- Seamless Cross-Border Transactions: Blockchain facilitates frictionless cross-border transactions, eliminating intermediaries and reducing transaction costs.

- Efficient Supply Chain Management: By incorporating blockchain into supply chain processes, businesses can track and trace goods in real-time, enhancing transparency and efficiency.

The Role of USDT Wallet in Driving Synergy

Among the myriad blockchain applications, USDT Wallet stands out as a catalyst for synergy between digital innovation and blockchain technology.

USDT, or Tether, is a type of cryptocurrency known as a stablecoin, pegged to the value of fiat currencies like the US dollar.

USDT Wallets provide users with a secure and convenient means of storing, sending, and receiving USDT tokens.

Here’s how USDT Wallet contributes to the synergy:

- Borderless Transactions: USDT Wallet enables users to conduct borderless transactions seamlessly, leveraging blockchain’s decentralized nature.

- Financial Inclusion: By providing access to digital assets like USDT, wallets promote financial inclusion, especially in regions with limited access to traditional banking services.

- Efficient Remittances: USDT Wallets streamline the process of remittances, enabling individuals to send and receive funds quickly and cost-effectively across borders.

- Integration with Digital Platforms: USDT Wallets can integrate with various digital platforms and applications, enhancing their functionality and utility.

- Secure Storage: With robust security features, USDT Wallets ensure the safe storage of digital assets, protecting users against cyber threats and fraud.

Empowering Decentralized Finance (DeFi)

One of the most promising areas where the synergy between digital innovation and blockchain technology is evident is in the realm of decentralized finance (DeFi).

DeFi represents a paradigm shift in traditional financial services, offering a decentralized alternative to banking and lending.

By leveraging blockchain technology, DeFi platforms enable peer-to-peer transactions, automated lending, and yield farming, among other financial services, without the need for intermediaries.

The integration of digital innovations like smart contracts further enhances the efficiency and transparency of DeFi protocols, creating a robust ecosystem for financial inclusion and innovation.

USDT Wallets play a pivotal role in this ecosystem, providing users with seamless access to stablecoins and facilitating frictionless transactions within the DeFi space.

As DeFi continues to gain momentum, powered by the synergy between digital innovation and blockchain technology, it has the potential to revolutionize the global financial landscape, democratizing access to financial services and driving financial empowerment on a scale never seen before.

Looking Ahead: Unleashing the Full Potential

As digital innovation continues to evolve, and blockchain technology matures, the synergy between the two will only strengthen.

From decentralized finance (DeFi) to digital identity management and beyond, the possibilities are limitless.

By harnessing this synergy, businesses can drive innovation, foster collaboration, and create value in unprecedented ways.

At the heart of this synergy lies the transformative power of technologies like USDT Wallet, bridging the gap between traditional finance and the digital future.

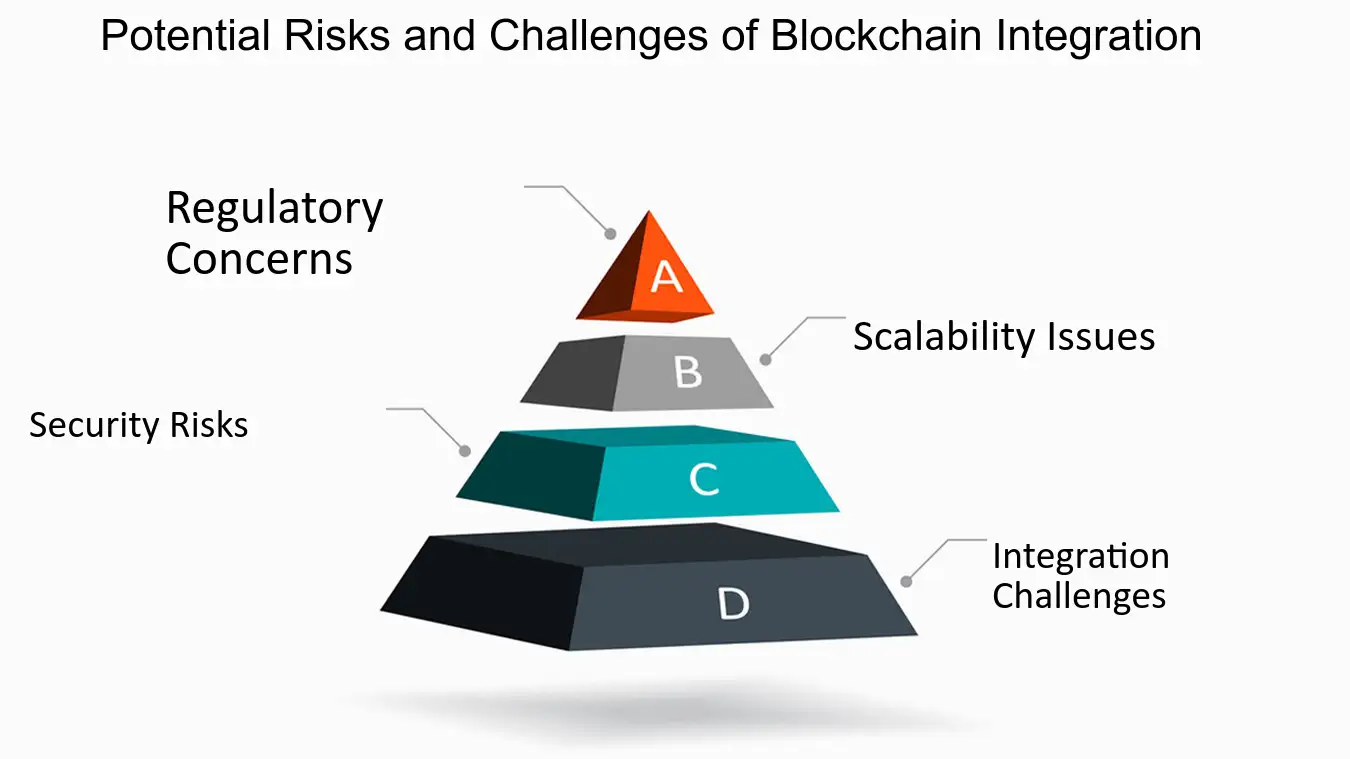

Primary Categories of Risks Associated with Blockchain

Blockchain technology, while offering significant advantages, also introduces various risks that organizations must carefully consider.

Here are the primary categories of risks associated with blockchain:

Security Risks

- Consensus Protocol Vulnerabilities: The decentralized nature of blockchain relies on consensus protocols to validate transactions. Vulnerabilities in these protocols can lead to attacks such as the 51% attack, where a single entity gains control over the majority of the network’s mining power, potentially allowing them to manipulate transaction records and double-spend assets.

- Smart Contract Defects: Smart contracts automate transactions based on pre-defined conditions. However, coding errors or vulnerabilities in these contracts can be exploited by attackers, leading to significant financial losses. For instance, a flaw in the DAO’s smart contract resulted in a $60 million theft in 2016.

- Private Key Compromise: Users’ private keys are crucial for accessing their blockchain assets. If these keys are compromised through phishing or other methods, attackers can gain unauthorized access to users’ funds. High-profile incidents, such as the Coincheck hack in 2017, highlight the importance of robust key management practices.

- Breach of Privacy and Confidentiality: Although blockchains are designed for transparency, this can inadvertently expose sensitive information. Attackers may analyze public blockchain data to infer private details about users or organizations.

Operational Risks

- Governance and Control Issues: Implementing blockchain solutions often involves multiple stakeholders, leading to complex governance structures. Poorly defined roles and responsibilities can result in operational inefficiencies and conflicts among participants.

- Integration Challenges: Integrating blockchain with existing systems can be fraught with technical difficulties. Organizations must address compatibility issues and ensure that data flows seamlessly between blockchain and traditional systems.

- System Outages and Resilience: While blockchain is touted for its resilience against centralized attacks, it is not immune to system outages or performance issues that can disrupt operations 6.

Regulatory and Legal Risks

- Regulatory Uncertainty: The legal landscape surrounding blockchain technology is still evolving. Organizations must navigate complex regulations related to data privacy (e.g., GDPR), anti-money laundering (AML), and know-your-customer (KYC) requirements, which can vary significantly across jurisdictions.

- Smart Contract Enforceability: The legal status of smart contracts remains ambiguous in many jurisdictions, raising questions about their enforceability and the potential for disputes arising from contract execution failures.

Financial Risks

- Volatility of Cryptocurrencies: Many blockchain applications involve cryptocurrencies that can be highly volatile. This volatility poses financial risks for organizations relying on these assets for transactions or investments.

- Funding Model Risks: The sustainability of blockchain projects often depends on their funding models. Inadequate funding can jeopardize project viability, particularly if reliant on initial coin offerings (ICOs) or member fees that may not materialize as anticipated.

While blockchain technology presents exciting opportunities for innovation and efficiency across various sectors, it is essential for organizations to conduct thorough risk assessments before implementation

Conclusion

In conclusion, the convergence of digital innovation and blockchain technology represents a paradigm shift in how we perceive and interact with technology. As we navigate this digital frontier, embracing this synergy will be crucial for unlocking new opportunities and driving sustainable growth in the digital age.

Read More: How To Convert Canva To HTML? (2 Simple Methods)

Contact US | ThimPress:

Website: https://thimpress.com/

Fanpage: https://www.facebook.com/ThimPress

YouTube: https://www.youtube.com/c/ThimPressDesign

Twitter (X): https://x.com/thimpress_com