Are you looking to understand how online transactions work and the roles of payment gateways and processors in facilitating these transactions? Today, businesses of all sizes rely on technology to accept payments securely and efficiently. A payment gateway vs payment processor are essential components of this system, each serving a distinct purpose in the transaction process.

This blog will provide a comprehensive overview of payment gateways and payment processors, explaining their functions, benefits, and how they work together to ensure seamless transactions for both merchants and customers.

Let’s get started!

Eduma – Education WordPress Theme

We provide an amazing WordPress theme with fast and responsive designs. Let’s find out!

Payment Gateway Overview

What is a Payment Gateway?

A payment gateway is a technology that enables merchants to accept payments online or in-store by securely transmitting customer payment information. It is an intermediary between the merchant’s website or point-of-sale (POS) system and the payment processor, ensuring that sensitive data is encrypted and securely transmitted for authorization.

How Does It Work?

The payment gateway functions through several key steps during a transaction:

- Collect Payment Information: The gateway captures the customer’s payment details, which may include credit card numbers, expiration dates, and CVV codes.

- Encryption: It encrypts the payment information to protect it from fraud and unauthorized access.

- Authorization Request: The encrypted data is sent to the payment processor for authorization.

- Response Transmission: The payment processor returns an authorization response (approved or declined) to the gateway, which then communicates this result to the merchant.

This process allows businesses to handle transactions securely and efficiently, especially in eCommerce settings where online fraud is prevalent.

Best Suited For

Payment gateways are particularly beneficial for:

- E-commerce Businesses: They are essential for online stores to accept payments securely.

- Subscription Services: Businesses that require recurring payments benefit from automated billing through gateways.

- In-Person Retailers: Retailers can use gateways integrated with POS systems to accept card payments securely.

Examples of Payment Gateways

Some popular payment gateways include:

- Stripe: Known for its developer-friendly API and support for various payment methods.

- PayPal: Offers both a payment gateway and processor, widely recognized and trusted by consumers.

- Authorize.Net: A long-standing player in the market, suitable for small businesses with straightforward pricing.

- Square: Provides integrated solutions for both online and in-person transactions.

Payment Processor Overview:

What is a Payment Processor?

A payment processor is a service that manages the transaction process between the customer’s bank (issuing bank) and the merchant’s bank (acquiring bank). It ensures that funds are transferred securely from the customer’s account to the merchant’s account after verifying transaction details.

How Does It Work?

The workflow of a payment processor involves several steps:

- Receive Transaction Details: The processor gets transaction data from the payment gateway.

- Validation: It validates the transaction details against various security checks.

- Authorization Request: The processor sends a request to the issuing bank for authorization of funds.

- Response Handling: Upon receiving an approval or decline from the issuing bank, it relays this information back to the payment gateway.

- Settlement: If approved, it coordinates the transfer of funds from the customer’s bank to the merchant’s account, typically taking a few days.

Best Suited For

Payment processors are ideal for:

- Businesses of All Sizes: Any business accepting electronic payments can benefit from using a processor.

- Global Transactions: They simplify handling multiple currencies and international payments.

- High-Traffic Retailers: Businesses with high transaction volumes can automate processes like reconciliation and reporting.

Examples of Payment Processors

Popular examples of payment processors include:

- Square: Offers a comprehensive solution for both online and offline sales without monthly fees.

- Stripe: Known for its robust API and support for various payment methods, making it suitable for developers.

- PayPal: Offers processing along with its gateway services, allowing merchants to accept payments easily.

- Helcim: A flexible solution catering to seasonal businesses and startups with transparent pricing.

Payment Gateway vs Payment Processor: Comparison Table

Understanding the differences between the payment gateway vs payment processor is essential for businesses looking to manage online transactions effectively. Below is a comparison table summarizing their key distinctions based on various sources.

| Features | Payment Gateway | Payment Processor |

| Role in Transaction Process | Collects, encrypts, and verifies payment information | Processes and authorizes payments; secures fund transfers |

| Intermediary Relationships | Acts as an intermediary between the customer and the merchant | Acts as an intermediary between the merchant’s bank and the customer’s bank |

| Functionality | Authorizes transactions, performs fraud checks, and communicates transaction status | Validates transaction details, facilitates fund transfer, and provides reporting |

| Integration Requirements | Must integrate with a payment processor for transaction completion | Can operate independently but often requires a merchant account |

| Scope of Services | Focuses on securely transmitting payment data; may lack advanced fraud detection | Offers additional services like fraud detection, chargeback management, and compliance |

| Best Use Cases | E-commerce payments, card-not-present transactions, subscription services | POS systems, high-volume merchants, international transactions |

| User Interaction | Customers interact with it during checkout (online or in-person) | Merchants interact with it to manage transactions and funds |

| Security Compliance | Ensures PCI compliance during data transmission | Maintains PCI compliance for processing payments |

Payment Gateway vs Payment Processor: How They Work Together?

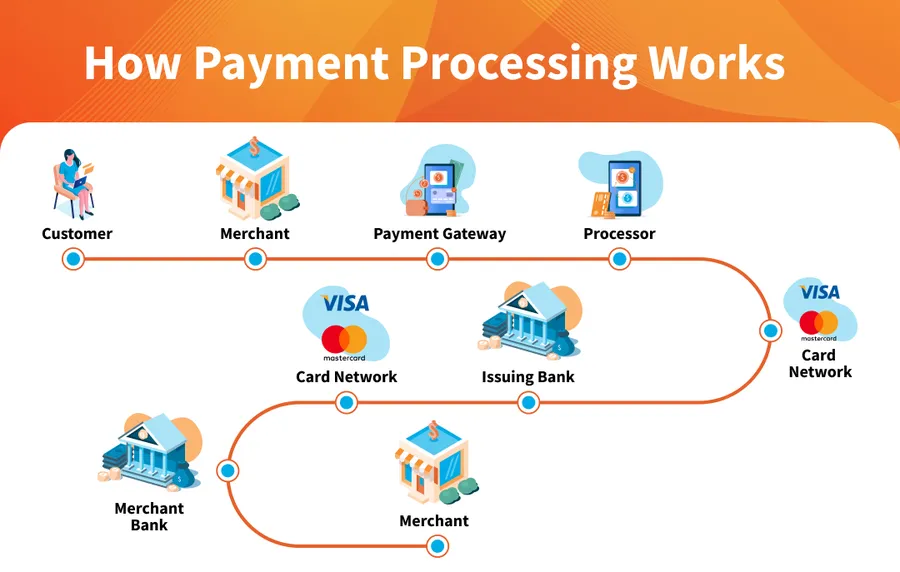

The collaboration between the payment processor vs payment gateway can be broken down into several key steps during a transaction:

- Initiation: The customer provides their payment information at checkout.

- Data Collection: The payment gateway collects this information, encrypts it for security, and forwards it to the payment processor.

- Authorization Request: The payment processor sends this encrypted data to the issuing bank to request authorization for the transaction.

- Verification: The issuing bank checks the customer’s account for available funds and either approves or declines the transaction.

- Response Transmission: The issuing bank sends its response back to the payment processor, which then relays this information back to the payment gateway.

- Finalization: The payment gateway communicates the transaction’s outcome to the merchant’s system, allowing it to display an appropriate message (approved or declined) to the customer.

- Settlement: If approved, the payment processor coordinates the transfer of funds from the customer’s bank account to the merchant’s account, completing the transaction process. For merchants operating across regions or using more than one provider, a payments orchestration platform sits above both the gateway and processor layers to route transactions intelligently (by BIN, country, amount, or risk score), provide automatic failover, harmonize 3DS/SCA flows, and unify reporting, improving approval rates while reducing total cost of acceptance.

FAQs

Q1: What’s the difference between a payment gateway and processor?

A payment gateway encrypts and safely sends payment info; a payment processor handles authorization and funds settlement.

Q2: Can one service act as both gateway and processor?

Yes—many providers like Stripe and PayPal act as both for streamlined integration and operations.

Q3: Do I need both to accept online payments?

Yes—typically both components are required (even if bundled by a PSP) to capture, authorize, and settle payments.

Q4: How long does settlement take?

Usually within 2–3 business days after authorization, though exact timing depends on the processor and merchant’s bank.

Q5: Which is better for small businesses?

PSPs (e.g., Stripe, PayPal) offer easy onboarding and simplified pricing—ideal for small to medium operations.

Final Thoughts: Payment Gateway vs Payment Processor

In conclusion, understanding the differences between the payment gateway vs payment processor is crucial for any business aiming to thrive in the digital marketplace. By recognizing their unique roles and how they collaborate, businesses can make informed decisions about which services best meet their needs. Whether you operate an e-commerce store, a subscription service, or a brick-and-mortar retail outlet, choosing the right payment solutions can enhance the customer experience and streamline your operations. As technology evolves, staying informed about these tools will empower you to adapt and succeed in an increasingly competitive landscape.

Read more: 8+ Best Free & Paid SEO Reporting Tools

Contact US | ThimPress:

Website: https://thimpress.com/

Fanpage: https://www.facebook.com/ThimPress

YouTube: https://www.youtube.com/c/ThimPressDesign

Twitter (X): https://x.com/thimpress_com