Securing funding for a new business can be challenging, especially when traditional options like bank loans or venture capital are out of reach. In fact, according to the Small Business Administration (SBA), about 33% of small businesses start with less than $5,000 in capital, making alternative funding sources essential.

One of the best crowdfunding sites and platforms can help bridge this gap by enabling entrepreneurs to raise money from a broad network of individual investors. Beyond fundraising, crowdfunding allows businesses to test new products, gauge customer interest, and offer exclusive rewards or equity in exchange for support.

In this guide, we’ll explore the best crowdfunding sites and platforms to help you fund your business, product, creative project, or nonprofit initiative.

Eduma – Education WordPress Theme

We provide an amazing WordPress theme with fast and responsive designs. Let’s find out!

What is Crowdfunding?

Crowdfunding is a process of raising funds from a large number of people, typically through the Internet. It allows individuals or businesses to collect small amounts of money from many people to finance a project, venture, or cause. (According to Wikipedia)

There are several popular types of crowdfunding:

- Donation-based crowdfunding: Relies on donations from supporters without offering any tangible rewards in return.

- Rewards-based crowdfunding: Offers rewards to backers in exchange for their contributions, such as physical products, digital content, or exclusive experiences.

- Equity-based crowdfunding: Allows backers to invest in the company in exchange for equity or ownership shares.

- Debt-based crowdfunding: Involves backers lending money to the project, which is repaid with interest.

One powerful tool for creating crowdfunding websites is the FundPress plugin. Designed for WordPress, FundPress makes it easy to set up and manage fundraising campaigns with features like seamless payment integration, customizable donation forms, and campaign progress tracking. Whether you’re raising money for a nonprofit, startup, or creative project, FundPress provides a user-friendly and flexible solution to help you reach your funding goals efficiently.

How does Crowdfunding Work?

Crowdfunding backers are motivated to support projects through a range of rewards, including but not limited to:

- Priority access to products, often at a discounted price.

- The ability to preorder products and have input on their development.

- Exclusive perks like ongoing discounts, higher customer loyalty status, or free merchandise.

- Direct interaction with the founding team or other backers.

- Equity ownership in the project or company.

- Access to exclusive content or experiences.

Crowdfunding platforms typically charge fees for hosting campaigns, transaction processing, and payment handling.

While each platform has unique features, fee structures, and community, the basic process is the same: you submit your project with a fundraising goal and deadline, then promote your campaign to attract backers. It’s useful to create a pitch deck as well, just in case.

Now, let’s explore the various crowdfunding sites and platforms available to help raise funds for your business!

TOP 10 Best Crowdfunding Sites and Platforms

Here are the TOP 10 best crowdfunding sites and platforms collected by ThimPress that will be useful for you:

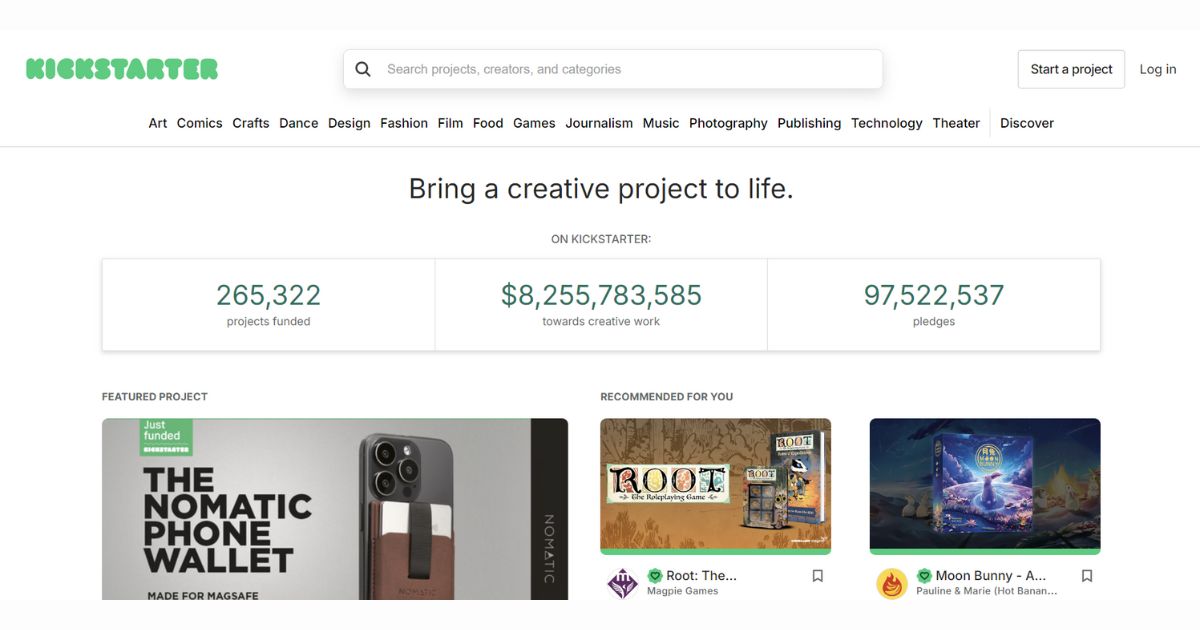

Kickstarter

Kickstarter is a global crowdfunding platform primarily focused on creative projects. It operates on an all-or-nothing funding model, meaning a project must reach its funding goal to receive any funds. If a project doesn’t meet its goal, all pledged funds are returned to backers.

Pros of Kickstarter:

- Strong community: Kickstarter has a large and active community of creators and backers, which can help projects gain visibility.

- All-or-nothing funding: This model creates a sense of urgency and can attract more backers.

- Rewards-based crowdfunding: Backers receive tangible rewards for their pledges, which can be motivating.

- Focus on creative projects: Kickstarter is specifically designed for innovative projects, which can attract a targeted audience.

Cons of Kickstarter:

- All-or-nothing funding: If a project doesn’t reach its goal, it receives no funding.

- Strict guidelines: Kickstarter has strict guidelines for project types and content, which can be limiting for some creators.

- High competition: Due to the popularity of the platform, there is a high level of competition among projects.

- No equity offered: Kickstarter does not offer equity crowdfunding, which may be a disadvantage for businesses seeking investment.

Fee of Kickstarter: 5% Kickstarter fee + 3%-5% payment processing fees. No fees if the project isn’t funded.

Indiegogo

Indiegogo is another popular crowdfunding platform, known for its flexibility and diverse range of projects. Unlike Kickstarter’s all-or-nothing model, Indiegogo offers both flexible funding and fixed funding options. This means a project can keep any funds raised, even if it doesn’t reach its goal.

Pros of Indiegogo:

- Flexibility: The platform offers both flexible and fixed funding options, providing more choice for creators.

- Diverse range of projects: Indiegogo covers a wider range of project categories than Kickstarter, making it suitable for a more diverse audience.

- Equity crowdfunding: Businesses seeking investment can offer equity stakes to investors through Indiegogo.

- Perks: Projects can offer a variety of rewards to backers, which can incentivize support.

- Global reach: Indiegogo has a global reach, allowing creators to reach a wider audience.

Cons of Indiegogo:

- Higher fees: Indiegogo’s fees can be higher than those of some other crowdfunding platforms (Charges a 5% fee in addition to transaction fees), especially for flexible funding projects.

- Less established community: While Indiegogo has a strong community, it may not be as established or active as Kickstarter’s.

- Competition: Due to the platform’s popularity and diversity, there is a high level of competition among projects.

Fee of Indiegogo: 5% platform fee + 2.9% + $0.30 credit card fee for USD payouts (subject to potential additional fees)

GoFundMe

GoFundMe is a popular crowdfunding platform primarily designed for personal causes and emergencies. Unlike Kickstarter and Indiegogo, which are often used for creative projects or business ventures, GoFundMe is focused on helping individuals and families in need.

Pros of GoFundMe:

- No fees: Fundraisers don’t have to pay any fees to use GoFundMe, making it a cost-effective option.

- Easy to use: The platform is designed to be user-friendly, making it accessible to people of all ages and technical abilities.

- Social sharing: Fundraisers can easily share their campaigns on social media to reach a wider audience.

- Verified campaigns: GoFundMe’s verification process can help build trust among donors.

- Focus on personal causes: The platform is specifically designed for personal causes, making it a good choice for individuals in need.

Cons of GoFundMe:

- Limited to personal causes: GoFundMe is not well-suited for business ventures or creative projects.

- No equity offered: GoFundMe does not offer equity crowdfunding, which may be a disadvantage for businesses seeking investment.

- Less control over funds: Unlike platforms like Kickstarter and Indiegogo, GoFundMe does not offer as much control over how funds are used.

Fee of GoFundMe: Charges no fees to fundraisers.

Patreon

Patreon is a crowdfunding platform specifically designed for creators to receive ongoing support from their fans. Unlike other crowdfunding platforms that focus on one-time campaigns, Patreon is built around a subscription-based model. This allows creators to earn a steady income by providing exclusive content or experiences to their patrons.

Pros of Patreon:

- Sustainable income: The subscription-based model can provide a steady income for creators.

- Exclusive content: Creators can offer exclusive content to their patrons, which can be a powerful incentive for support.

- Community: Patreon fosters a strong community between creators and their patrons, allowing for direct interaction and feedback.

- Payment processing: Patreon handles all payment processing, making it easy for creators to manage their finances.

- Flexibility: Creators have a lot of flexibility in terms of the content they offer and the tiers of membership they create.

Cons of Patreon:

- Requires an existing following: Patreon is most effective for creators who already have a dedicated fanbase.

- Consistent content creation: Creators must consistently produce high-quality content to retain their patrons.

- Competition: There is a high level of competition among creators on Patreon, making it important to stand out.

- Limited to certain types of content: Patreon is best suited for creators who produce content that can be easily delivered digitally, such as videos, music, or articles.

Fee of Patreon: Charges a platform fee of 5% of the total funds raised.

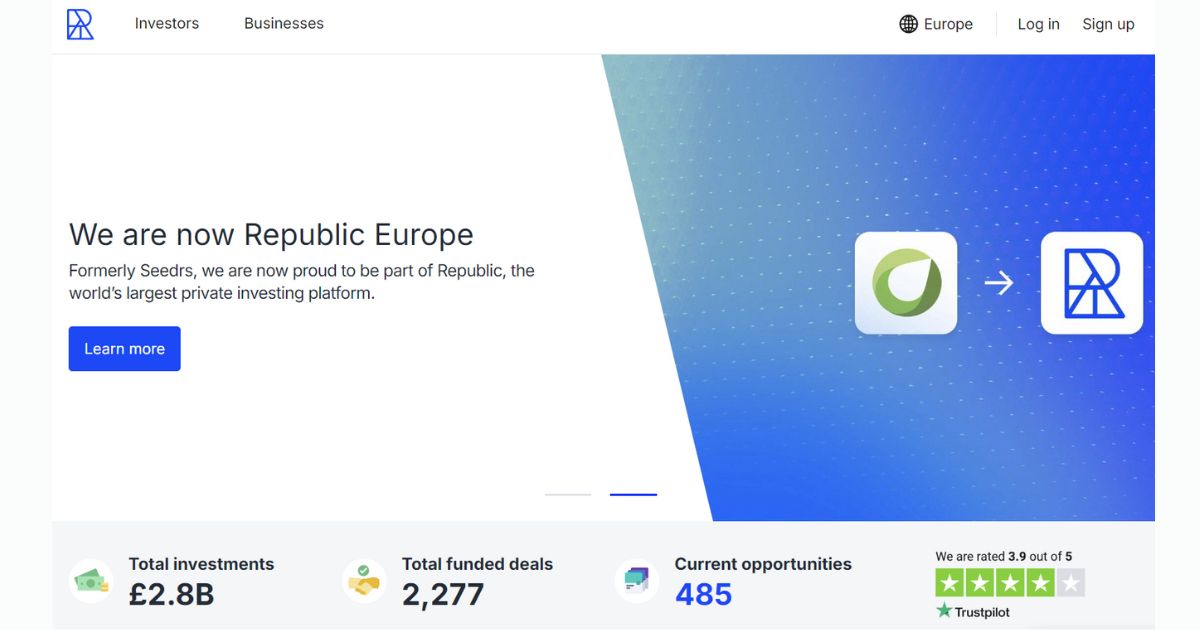

Republic Europe (Formerly Seedrs)

Republic Europe is a popular equity crowdfunding platform that allows businesses to raise capital by selling shares to investors. Unlike traditional crowdfunding platforms that focus on rewards-based funding, Republic Europe offers investors the opportunity to become part-owners of the company.

Pros of Republic Europe:

- Equity crowdfunding: Investors become part-owners of the company, potentially sharing in its future success.

- Due diligence: Republic Europe conducts due diligence on companies, providing investors with more information.

- Investor protection: The platform has measures in place to protect investors.

- International reach: Republic Europe operates in multiple countries, allowing businesses to access a global investor base.

- Flexible investment amounts: Investors can choose to invest varying amounts, depending on their risk tolerance and budget.

Cons of Republic Europe:

- Minimum investment amounts: There are minimum investment amounts, which may be a barrier for some investors.

- Risk of loss: Investing in equity crowdfunding involves the risk of losing your investment if the company fails.

- Regulatory compliance: Republic Europe must comply with various regulations, which can be complex and time-consuming.

- Competition: There is a high level of competition among companies seeking funding in Republic Europe, making it important to stand out.

Fee of Republic Europe: Typically charges a platform fee of 3-7% of the total funds raised.

Crowdcube

Crowdcube is a popular equity crowdfunding platform that allows businesses to raise capital by selling shares to investors. Similar to Seedrs, Crowdcube offers investors the opportunity to become part owners of the company.

Pros of Crowdcube:

- Equity crowdfunding: Investors become part owners of the company, potentially sharing in its future success.

- Due diligence: Crowdcube conducts due diligence on companies, providing investors with more information.

- Investor protection: The platform has measures in place to protect investors.

- International reach: Crowdcube operates in multiple countries, allowing businesses to access a global investor base.

- Flexible investment amounts: Investors can choose to invest varying amounts, depending on their risk tolerance and budget.

Cons of Crowdcube:

- Minimum investment amounts: There are minimum investment amounts, which may be a barrier for some investors.

- Risk of loss: Investing in equity crowdfunding involves the risk of losing your investment if the company fails.

- Regulatory compliance: Crowdcube must comply with various regulations, which can be complex and time-consuming.

- Competition: There is a high level of competition among companies seeking funding on Crowdcube, making it important to stand out.

Fee of Crowdcube: No listing fee, a 7% success fee on funds raised, and a completion fee of around 0.75% to 1.5%.

Fundable

Fundable is a popular crowdfunding platform that offers both equity crowdfunding and rewards-based crowdfunding. This flexibility allows businesses to choose the funding method that best suits their needs and goals.

Pros of Fundable:

- Flexibility: Fundable offers both equity crowdfunding and rewards-based crowdfunding, providing businesses with more options.

- Due diligence: The platform conducts due diligence on companies, providing investors with more information.

- Investor protection: Fundable has measures in place to protect investors.

- International reach: Fundable operates in multiple countries, allowing businesses to access a global investor base.

- Diverse range of projects: Fundable covers a wide range of project categories, making it suitable for various businesses.

Cons of Fundable:

- Higher fees: Fundable fees can be higher than those of some other crowdfunding platforms, especially for equity crowdfunding.

- Less established than Kickstarter and Indiegogo: Fundable may not be as well-known as some other crowdfunding platforms, which could impact visibility.

- Competition: There is a high level of competition among companies seeking funding on Fundable, making it important to stand out.

- Regulatory compliance: Fundable must comply with various regulations, which can be complex and time-consuming.

Fee of Fundable: $179 per month, plus 3.5% plus 30¢ transaction fee for any funds collected via credit card.

MicroJustice

MicroJustice is a crowdfunding platform specifically designed for social justice and charitable causes. It provides a platform for individuals and organizations to raise funds for projects that promote equality, human rights, and social change.

Pros of MicroJustice:

- Social justice focus: MicroJustice is dedicated to supporting social justice causes, which can attract a targeted audience of socially conscious individuals.

- Low fees: MicroJustice charges lower fees compared to some other crowdfunding platforms, making it a cost-effective option.

- Community: The platform has a strong community of socially conscious individuals and organizations, which can help projects gain visibility.

- Easy to use: MicroJustice is designed to be user-friendly, making it accessible to people of all ages and technical abilities.

- Impactful projects: MicroJustice focuses on projects that have a positive impact on society, which can be motivating for donors.

Cons of MicroJustice:

- Niche focus: MicroJustice is specifically designed for social justice and charitable causes, which may limit its appeal to a narrower audience.

- Less established than other platforms: MicroJustice may not be as well-known as some other crowdfunding platforms, which could impact visibility.

- Competition: There is a high level of competition among projects on MicroJustice, making it important to stand out.

- Limited funding options: MicroJustice primarily focuses on rewards-based crowdfunding, which may not be suitable for all types of projects.

Fee of MicroJustice: Charges a platform fee of 3 – 5% of the total funds raised.

RocketHub

RocketHub is a crowdfunding platform that offers both equity crowdfunding and rewards-based crowdfunding. This flexibility allows businesses and individuals to choose the funding method that best suits their needs and goals.

Pros of RocketHub:

- Flexibility: RocketHub offers both equity crowdfunding and rewards-based crowdfunding, providing businesses with more options.

- Due diligence: The platform conducts due diligence on companies, providing investors with more information.

- Investor protection: RocketHub has measures in place to protect investors.

- International reach: RocketHub operates in multiple countries, allowing businesses to access a global investor base.

- Diverse range of projects: RocketHub covers a wide range of project categories, making it suitable for various businesses.

Cons of RocketHub:

- Higher fees: RocketHub’s fees can be higher than those of some other crowdfunding platforms, especially for equity crowdfunding.

- Less established than Kickstarter and Indiegogo: RocketHub may not be as well-known as some other crowdfunding platforms, which could impact visibility.

- Competition: There is high competition among companies seeking funding on RocketHub, making it important to stand out.

- Regulatory compliance: RocketHub must comply with various regulations, which can be complex and time-consuming.

Fee of RocketHub: RocketHub’s fees depend on whether your project is successful. If it reaches its goal, you’ll pay 4% + 4%. But if it fails, the fees double to 8% + 4%.

Conclusion: Crowdfunding Sites and Platforms

In conclusion, each of the top 10 Crowdfunding Sites and Platforms has its own special features, cost plans, and community involvement programs, meeting the demands of various project kinds and financing sources.

Whether you’re looking for reward-based, donation-based, or equity-based fundraising, there’s a platform designed to support you in achieving your objectives and building strong relationships with backers. Choosing the best one will rely on the audience, budget, and needs of your project.

Contact US | ThimPress:

Website: https://thimpress.com/

Fanpage: https://www.facebook.com/ThimPress

YouTube: https://www.youtube.com/c/ThimPressDesign

Twitter (X): https://x.com/thimpress_com