Are you building a store on Shopify and feeling overwhelmed by the technicalities of choosing the right payment gateway?

You are not alone; for many merchants, the “Buy Now” button is the most critical component of an online store. However, the technology powering that button—the best Shopify payment gateways—is often overlooked until a problem arises.

Today, a payment gateway is more than just a credit card processor; it is the engine of your revenue.

Whether you are dealing with high transaction fees, international currency conversion, or abandoned carts, the right gateway can solve these friction points.

This guide breaks down exactly why you need a specialized gateway, how they function, and the top 10 options available to Shopify users this year.

COMA – Modern Multipurpose Shopify Theme OS 2.0

We provide an amazing Shopify theme with fast and responsive designs. Let’s find out!

Why Do You Need A Shopify Payment Gateway?

A payment gateway acts as the secure bridge between your customer’s wallet and your business bank account. Without it, you simply cannot accept digital payments.

- Security & Compliance: It encrypts sensitive credit card data, ensuring you never have to store risky financial information on your own servers.

- Global Reach: It allows you to accept local payment methods (like wallets or bank transfers) that are preferred in different regions.

- Trust: Displaying recognized payment logos at checkout significantly reduces cart abandonment rates.

How Shopify Payment Gateways Work

To troubleshoot issues or explain charges to customers, it helps to understand the lifecycle of a transaction:

- Encryption: When a customer enters their card details, the gateway encrypts this data immediately.

- Authorization: The gateway sends a request to the customer’s bank (the issuing bank) to check if they have enough funds.

- Verification: The bank sends a “Yes” (Approved) or “No” (Declined) signal back to the gateway.

- Settlement: If approved, the money is deducted from the customer and held by the processor before being transferred to your merchant account.

Top 10 Best Shopify Payment Gateways

We have analyzed the market to bring you the top contenders based on reliability, fees, and feature sets.

1. Shopify Payments

Shopify Payments is the default, integrated solution for most merchants. It is the only option that allows you to avoid the additional “third-party transaction fee” that Shopify otherwise charges. When performing a Shopify transaction fees comparison, this gateway almost always wins on pure cost-efficiency for core markets because it eliminates that extra 0.6%–2% surcharge.

Key Features:

- Built natively into the Shopify dashboard (no external logins).

- Includes “Shop Pay” for accelerated one-click checkouts.

- Supports local currencies and multi-currency selling automatically.

- Unified payout and dispute management.

- No additional third-party transaction fees.

Pricing:

- Online: ~2.5% to 2.9% + 30¢ (depending on your Shopify plan).

- Monthly Fee: $0 (Included in Shopify subscription).

2. PayPal

PayPal remains a global giant in trust. For many merchants, the debate often comes down to Shopify Payments vs PayPal vs Stripe. Ideally, you should use PayPal alongside Shopify Payments. It acts as a digital wallet that allows customers to pay using their saved balance or bank accounts without typing in credit card numbers, which is vital for mobile conversion.

Key Features:

- Massive brand recognition builds instant buyer trust.

- Buyer and Seller Protection programs reduce fraud risk.

- One-touch checkout for logged-in users.

- Supports payments via bank transfer, balance, or card.

- Available in 200+ countries.

Pricing:

- Domestic: ~3.49% + 49¢ per transaction.

- International: Additional 1.5% fee is common.

3. Stripe

While Shopify Payments is powered by Stripe, using a standalone Stripe account is sometimes necessary for specific regions or custom setups. It is widely regarded as one of the best international payment gateways for Shopify due to its ability to handle over 135 currencies and sophisticated developer tools.

Key Features:

- Stripe Radar offers industry-leading AI fraud detection.

- Highly customizable checkout flow (requires developer knowledge).

- Excellent for subscription and recurring billing models.

- Supports local payment methods (Alipay, SEPA, etc.).

- Real-time financial reporting.

Pricing:

- Standard: 2.9% + 30¢ per transaction.

- International cards: +1.5% fee.

4. Square Payments

Square is primarily known for its dominance in physical retail. While it does not integrate as a “native” online gateway as smoothly as others, it is a top contender for best Shopify payment gateways if your business relies heavily on in-person sales (POS) and you want to sync inventory across offline and online channels.

Key Features:

- Best-in-class POS hardware for physical stores.

- Syncs online and offline inventory.

- Simple flat-rate pricing structure.

- Next-day business day deposits.

- Strong invoicing tools.

Pricing:

- Online: 2.9% + 30¢.

- In-person: 2.6% + 10¢.

5. Adyen

Adyen is the payment engine behind enterprise giants like Uber and Spotify. It is one of the premier international payment gateways for Shopify for high-volume merchants because it supports hundreds of local payment methods globally, ensuring customers in Europe or Asia can pay with their preferred local apps rather than just Visa or Mastercard.

Key Features:

- “Interchange++” pricing model (transparent fees for high volume).

- Omnichannel support (online, mobile, and in-store).

- Dynamic routing to increase transaction approval rates.

- Native risk management tools.

- Direct connection to card schemes (Visa/Mastercard) for speed.

Pricing:

- Processing Fee: ~13¢ + Interchange fees (varies by card type).

6. Amazon Pay

Amazon Pay leverages the trust of the world’s largest retailer. By allowing customers to check out using the shipping and payment details already stored in their Amazon account, you reduce friction significantly. This is a strong addition to any list of best Shopify payment gateways for merchants targeting mobile shoppers who hate typing addresses.

Key Features:

- One-click checkout experience using Amazon credentials.

- High trust factor for new visitors.

- Reduces cart abandonment by auto-filling forms.

- Advanced fraud protection backed by Amazon’s technology.

- Voice purchasing capability (Alexa).

Pricing:

- Domestic: 2.9% + 30¢.

- Cross-border: 3.9% + 30¢.

7. Klarna

Klarna has revolutionized the “Buy Now, Pay Later” (BNPL) market. It is distinct from standard credit card processors because it focuses on consumer financing. By letting customers pay in installments while you get paid upfront, Klarna is one of the best Shopify payment gateways for increasing Average Order Value (AOV).

Key Features:

- Splits purchases into 4 interest-free payments.

- Merchant is paid in full immediately (Klarna takes the risk).

- On-site messaging shows installment prices on product pages.

- High popularity among Gen Z and Millennial shoppers.

- Decreases price sensitivity for expensive items.

Pricing:

- Transaction Fee: Varies, typically up to 5.99% + 30¢ depending on the plan.

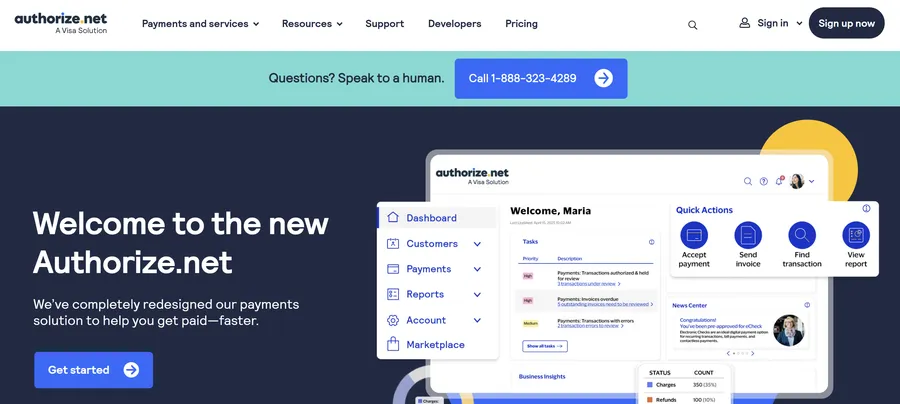

8. Authorize.net

Authorize.net is a veteran in the industry, owned by Visa. It is a robust choice for businesses that need a traditional merchant account connection. It is often favored by businesses that need highly specific fraud filters or those that might be borderline for other gateways, making it a reliable alternative to high-risk payment gateways Shopify lists often mention.

Key Features:

- Advanced Fraud Detection Suite (AFDS).

- Connects to almost any merchant bank account.

- Supports recurring billing and eChecks.

- Secure customer data management (CIM).

- 100% uptime reliability record.

Pricing:

- Gateway Fee: $25/month.

- Transaction Fee: 2.9% + 30¢.

9. Skrill

Skrill is a popular digital wallet in Europe and acts as a strong alternative for niche industries. It is frequently cited when discussing high-risk payment gateways Shopify merchants can use, particularly for digital goods, gaming, or industries where chargeback risks are higher than average.

Key Features:

- Specializes in digital goods and gaming sectors.

- Chargeback protection features.

- Supports over 40 currencies.

- High security for cross-border transactions.

- One-tap payments for repeat customers.

Pricing:

- Fees: Varies widely based on industry, typically 1.2% to 2.9% + fixed fees.

10. Opayo (formerly Sage Pay)

Opayo is a highly trusted name in the UK and European markets. If your customer base is located in these regions, Opayo is arguably one of the best Shopify payment gateways due to its flat monthly fee structure, which can be very cost-effective for high-volume businesses compared to percentage-based models.

Key Features:

- Flat monthly fee options available.

- Level 1 PCI DSS compliance (highest security).

- 24/7 UK-based customer support.

- Seamless integration with Sage accounting software.

- Strong fraud screening tools.

Pricing:

- Flex Plan: ~£25/month for 350 transactions.

- Corporate: Custom pricing for large volumes.

Factors to Consider When Choosing a Gateway

- Target Audience Location: If you sell globally, you need international payment gateways for Shopify like Adyen or Stripe that support local methods (e.g., iDEAL in the Netherlands).

- Product Type: If you sell high-risk items (vaping, travel, etc.), standard gateways like Shopify Payments may ban you. Look for high-risk payment gateways Shopify supports, such as Authorize.net or specialized processors.

- Total Costs: Perform a Shopify transaction fees comparison. Remember that using a third-party gateway (like Authorize.net) triggers an extra 0.6%–2% fee from Shopify, whereas Shopify Payments does not.

- Checkout Experience: Gateways that keep customers on your site (integrated) generally convert better than those that redirect them to a separate page (hosted).

FAQs About Best Shopify Payment Gateways

Q: Can I use multiple payment gateways on Shopify? A: Yes. You can typically use one primary credit card gateway (like Shopify Payments) and add “alternative” payment methods like PayPal, Amazon Pay, or Klarna alongside it.

A: Yes. You can typically use one primary credit card gateway (like Shopify Payments) and add “alternative” payment methods like PayPal, Amazon Pay, or Klarna alongside it.

Conclusion

Selecting the best Shopify payment gateways is a balance between cost, customer experience, and coverage. For most new merchants, the combination of Shopify Payments (for credit cards) and PayPal (for digital wallets) covers 90% of use cases effectively. However, as you scale into new markets or high-ticket items, adding specialized tools like Adyen or Klarna can significantly boost your bottom line.

Read more: 6+ Best Shopify AI Blog Generators to Boost Traffic

Contact US | ThimPress:

Website: https://thimpress.com/

Fanpage: https://www.facebook.com/ThimPress

YouTube: https://www.youtube.com/c/ThimPressDesign

Twitter (X): https://x.com/thimpress_com